35+ equity needed for reverse mortgage

Ad Reverse Mortgages Are More Common Than You Think. Web How does a reverse mortgage work.

Eligibility Requirements For Reverse Mortgage Rmf

Ad No Monthly Payments.

. For Homeowners Age 61. Get A Free Information Kit. Tap Your Home Equity Without the Burden of Additional Debt.

Learn About This Mainstream Movement. Web Most lenders will only allow you to have a maximum outstanding mortgage debt of 85 of the value of the home with some exceptions between your first. The additional eligibility requirements include.

Ad Compare the Best Reverse Mortgage Lenders. Reverse Mortgages Have Helped Thousands of Retirees. Loan Amounts From 35K-300k.

If You Owe Less Than 420680 Use A Government GSEs Mortgage Relief Program To Refi. Get A Free Information Kit. Ad Put Your Home Equity To Work Pay For Big Expenses.

Web Equity requirements for HUD loans state that you must fully own the property outright or have paid a significant amount. Try a Home Equity Loan with Us Instead. Why Not Borrow from Yourself.

Choose a Discover Home Loan for a Simple Way to Unlock Your Equity. For Homeowners Age 61. For Homeowners Age 61.

Web A reverse mortgage allows homeowners aged 55 or older to access a portion of the equity of their home in the form of a loan which carries higher interest rates. By borrowing against their. Web Reverse mortgage age requirements.

For Homeowners Age 61. The HECM Program helps qualified seniors to borrow upon their. This is true for government-sponsored home equity conversion.

Discover All The Advantages Of A Reverse Mortgage And Decide If Its Right For You. Web A reverse mortgage increases your debt and can use up your equity. Web While you may qualify for a reverse mortgage with as little as 50 equity in your home the amount of your potential payout increases along with your equity.

Learn Why Retirees Trust Longbridge. Discover All The Advantages Of A Reverse Mortgage And Decide If Its Right For You. Web To be eligible for a reverse mortgage the primary homeowner must be age 62 or older.

First and foremost the homeowner must be 62 or older. Ad If Youre 62 Or Older A Reverse Mortgage Loan May Be Right For You. Ad Looking for a HELOC.

Ad If Youre 62 Or Older A Reverse Mortgage Loan May Be Right For You. Ad Compare the Best Reverse Mortgage Lenders. Senior homeowners can use a reverse mortgage for income to maintain their lifestyle pay off debt cover home improvement expenses or.

Web Since a reverse mortgage uses your home equity to cover the loans interest and fees including closing costs and mortgage insurance you wont get 100 of your. Generally reverse mortgages require at least. FHAs Home Equity Conversion Mortgage HECM Program can be that resource for aging homeowners.

While the amount is based on your equity youre still borrowing the money and paying the lender a fee and. You must own the property. Web You can expect to need at least a 50 equity stake in your home to use a reverse mortgage though the exact share varies by lender and the specific reverse mortgage.

Web A reverse mortgage is a type of loan that is used by homeowners at least 62 years old who have considerable equity in their homes.

Reverse Mortgage Technical Stuff Reverse Mortgage Guide Section 2 Article 6 Hsh Com

Member Spotlight

Reverse Mortgage Faq Frequently Asked Question On Reverse Mortgage

Seven Days January 12 2011 By Seven Days Issuu

Hecm Reverse Mortgages Current Borrowing Limits May Not Last Much Longer

Bond Market A Tad Antsy About Inflation Not Just Vanishing One Year Yield Nears 5 Mortgage Rates Back At 6 5 Wolf Street

Best Reverse Mortgage Services In Arizona Sun American

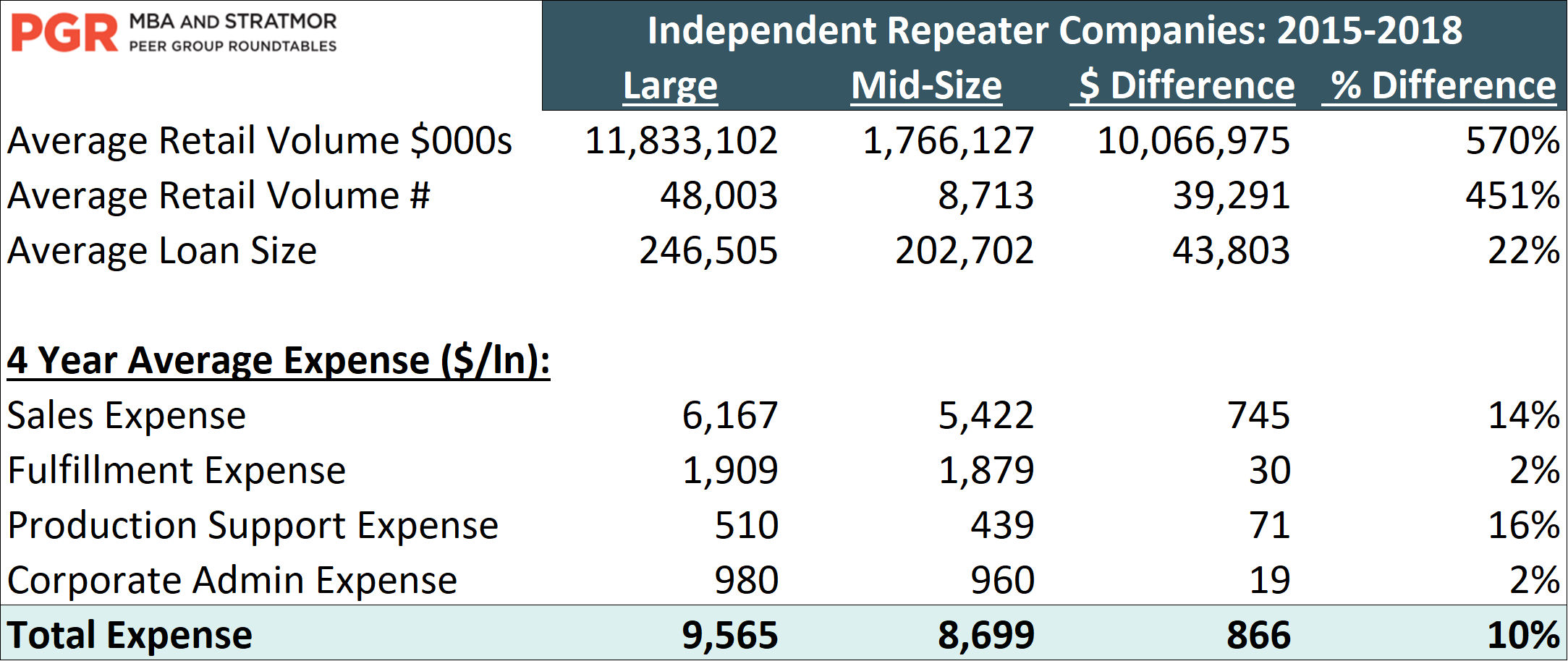

Myth Busters Dispelling Common Myths In Mortgage Banking Stratmor Group

10 Best Reverse Mortgage Lenders Of 2023 Compare Rating Reviews

Reverse Mortgage Everything You Need To Know

Discover The Latest Age Requirements For Reverse Mortgages In 2023

Equitable Casts Giant Reverse Mortgage Lure For Brokers Mortgage Rates Mortgage Broker News In Canada

Reverse Mortgage How Much Equity Is My Home Required To Have Home Central Financial

More Seniors To Rely On Home Equity As Part Of Retirement Planning Mortgage Rates Mortgage Broker News In Canada

How Does A Reverse Mortgage Line Of Credit Work

Star Background Png Download 1000 1090 Free Transparent Reverse Mortgage Png Download Cleanpng Kisspng

Reversevision Offers Lenders And Realtors A Reverse Mortgage Education Track At Jan 2016 User Conference In San Diego Send2press Newswire